Back

18 Feb 2020

EUR/USD New York Price Forecast: Euro extends losses, challenges 1.8000 figure

- EUR/USD is consolidating sideways near 34-month lows as the new week is kicking off.

- The level to beat for bears is the 1.0826 support.

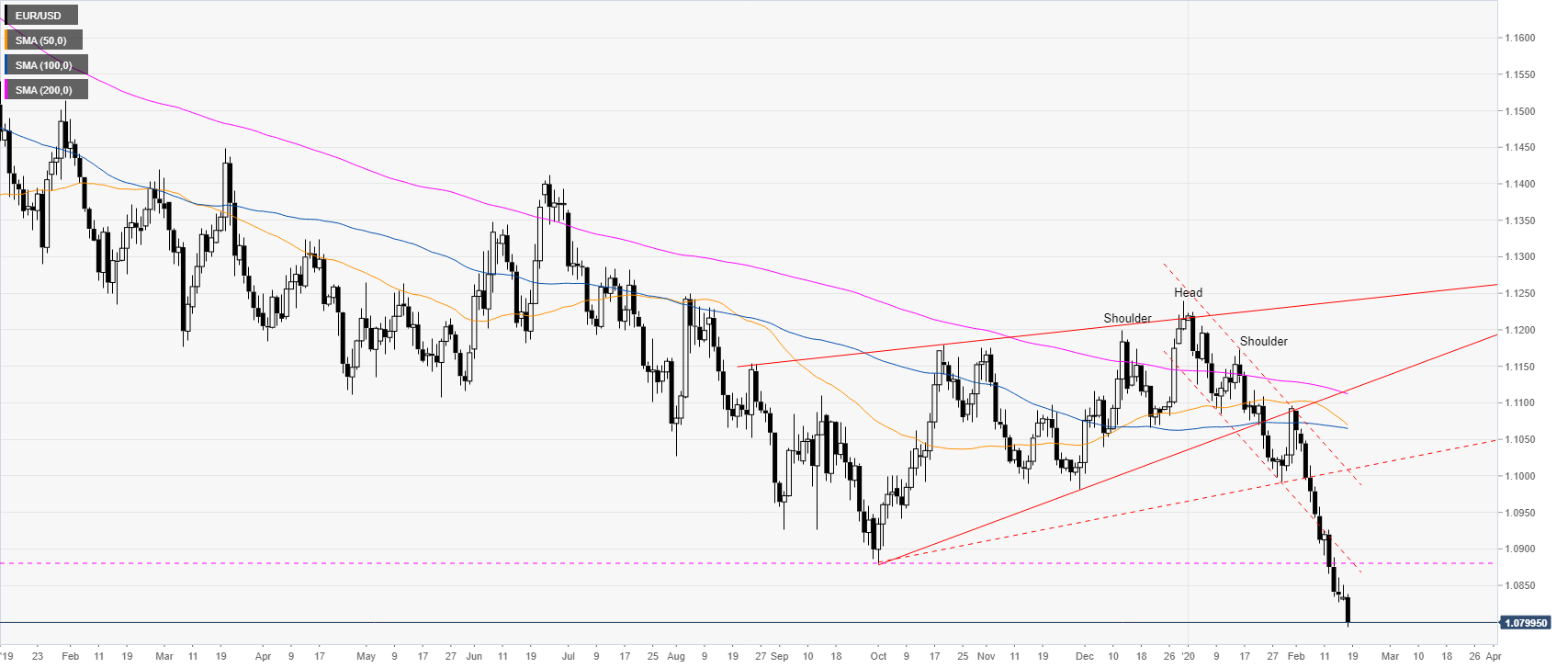

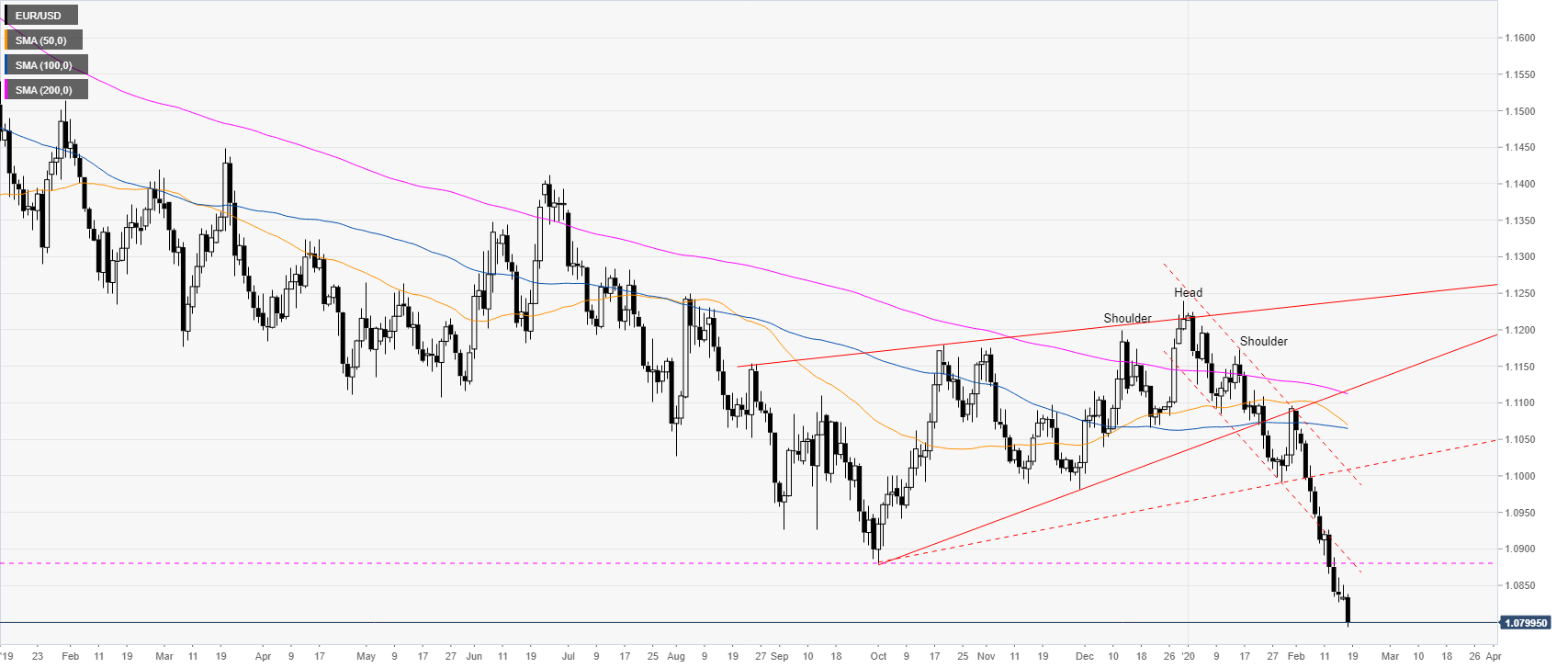

EUR/USD daily chart

EUR/USD is trading in a bear trend below the main daily simple moving averages (SMAs) as the quote under strong selling pressure near 34-month lows. The spot is trading below the 2019 lows. NY Empire State Manufacturing Index jumps to 12.9 in February vs. 5 expected.

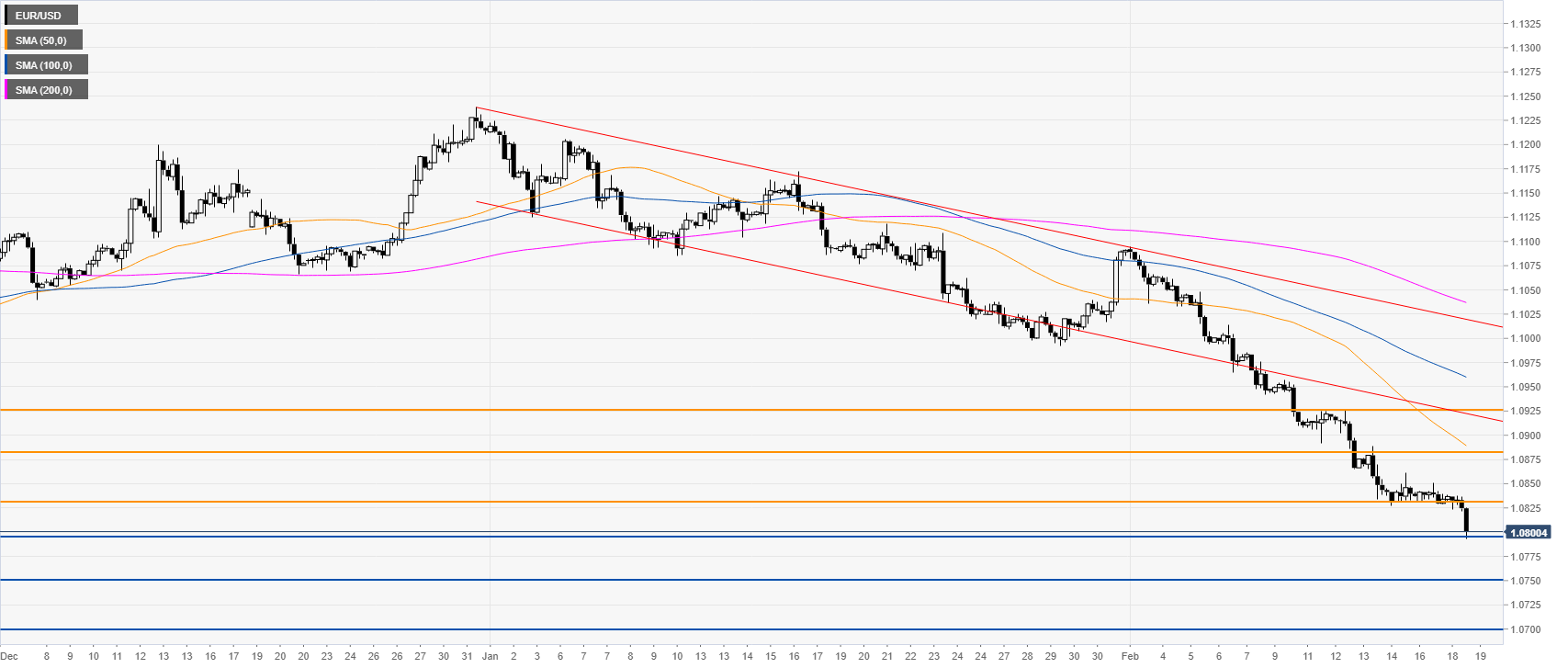

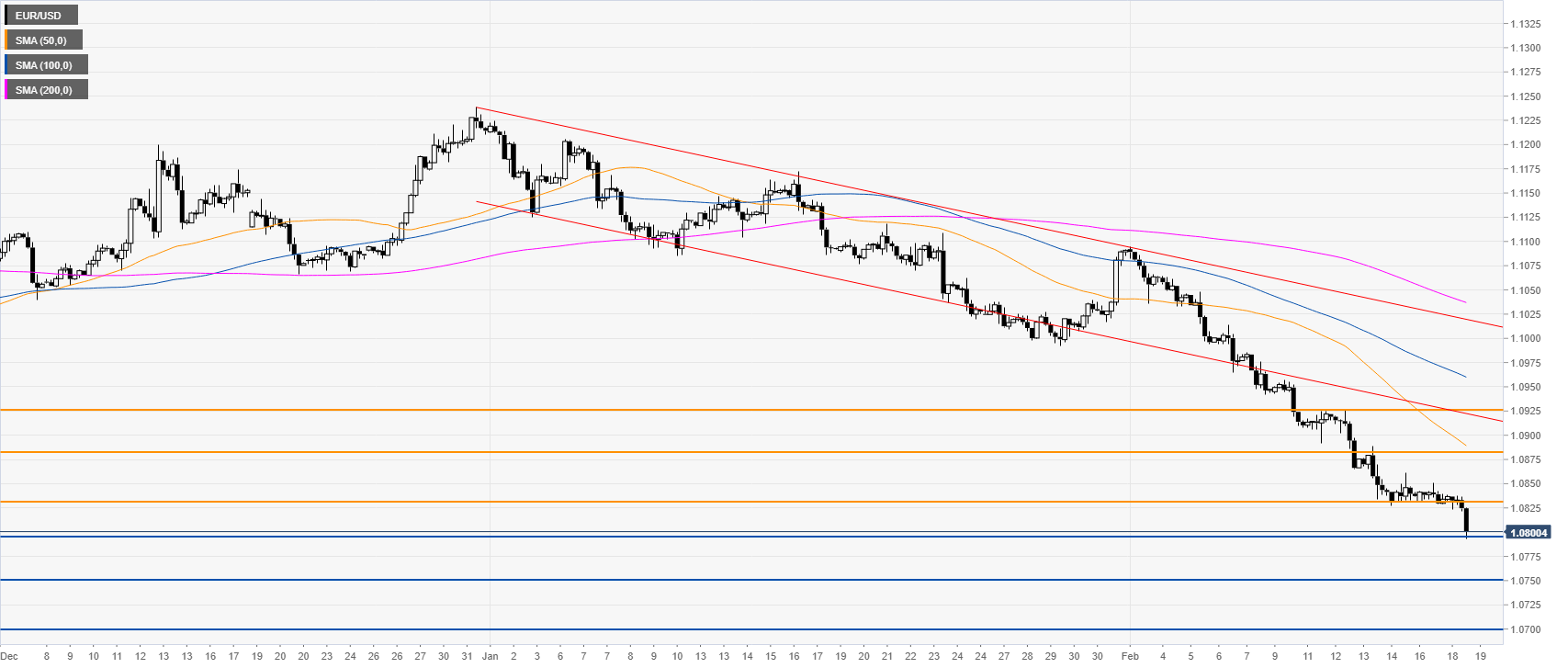

EUR/USD four-hour chart

The euro broke below a bear channel while trading well below the main SMAs on the four-hour chart. The spot had another bear leg challenging the 1.0800 level and multi-year lows. Bears will be looking for a break below the 1.0796 support to reach the 1.0752 and 1.0700 price levels. Resistance is seen near the 1.0830, 1.0880 and 1.0925 levels, according to the Technical Confluences Indicator.

Resistance: 1.0830, 1.0880, 1.0925

Support: 1.0796, 1.0752, 1.0700

Additional key levels